Soybean slump continues with double-digit setback

Afternoon market recap: Corn prices also trend lower on Thursday, while wheat stands firm.

At a Glance

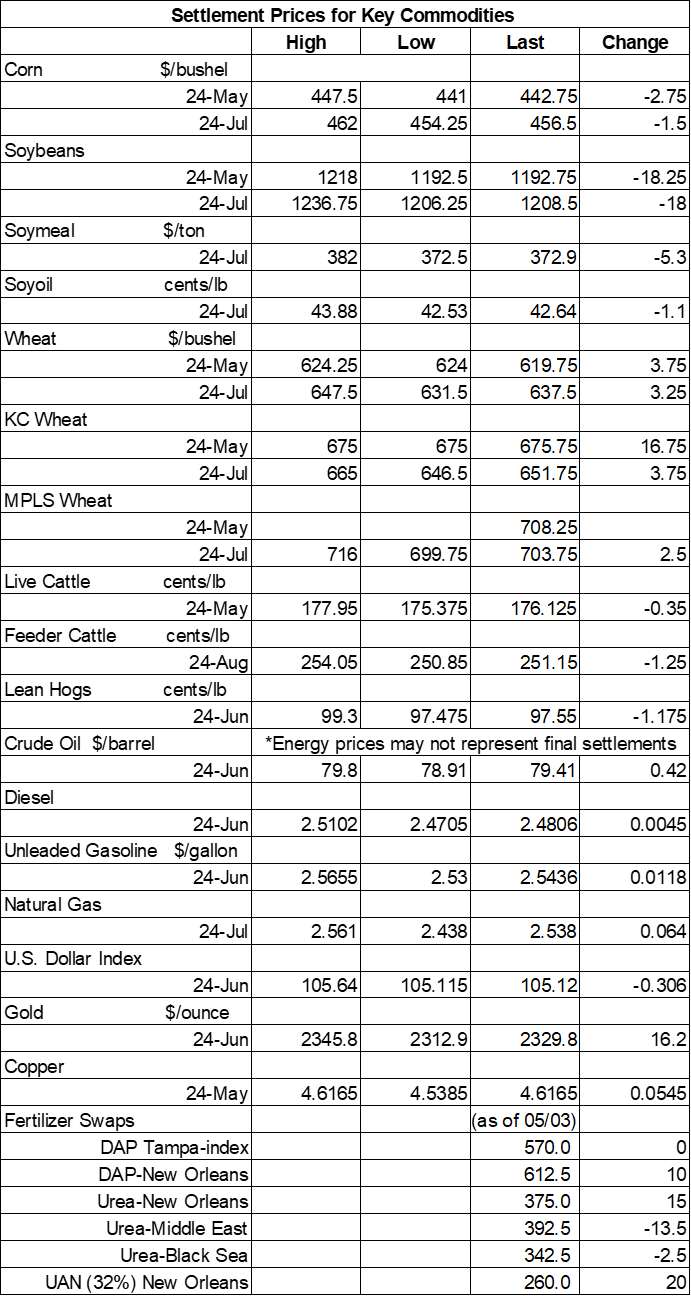

- Corn prices fade modest cuts, while soybeans slump 1.5% lower

- Wheat test modest gains, with most July contracts up around 0.5%

- Plus: Will drones ever replace ground sprayers?

Don’t miss the latest market commentary from the Farm Futures team. Sign up for the complimentary morning and afternoon market newsletters!

Grains were mixed but mostly lower as traders squared positions one last time before Friday morning’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA. Wheat prices enjoyed some mild to moderate gains on lingering weather worries coming out of Russia. In contrast, corn prices slid slightly lower, and soybeans faced 1.5% cuts after a round of technical selling today.

Modest rains are likely for most of the Corn Belt between Friday and Monday, although very few fields will gather more than 0.25” during this time, per the latest 72-hour cumulative precipitation map from NOAA. Later on, NOAA’s new 8-to-14-day outlook predicts seasonally wet weather for most of the Midwest and Plains between May 16 and May 22, with warmer-than-normal temperatures also likely for most of the central U.S.

On Wall St., the Dow climbed another 273 points higher in afternoon trading to 39,329, making it highly likely it will close higher for the seventh consecutive session. Investors are banking on multiple interest rate cuts by the Federal Reserve later this year. Energy futures were lightly mixed, with crude oil testing modest gains of around 0.1%, staying just above $79 per barrel. Gasoline was also up around 0.1%, while diesel tracked 0.1% lower. The U.S. Dollar softened moderately.

On Wednesday, commodity funds were net sellers of all major grain contracts, including corn (-6,500), soybeans (-7,500), soymeal (-2,000), soyoil (-2,500) and CBOT wheat (-4,500).

Corn

Corn prices faced a modest technical setback that was partly spurred by spillover weakness from soybeans. May futures dropped 2.75 cents to $4.4275, with July futures down 1.5 cents to $4.57.

Corn basis bids inched a penny higher at an Ohio elevator while sliding 2 to 5 cents lower at two other Midwestern locations and holding steady elsewhere across the central U.S. on Thursday.

Private exporters announced to USDA the sale of 5.2 million bushels of corn to Mexico. Of the total, 46% was for delivery during the current marketing year, with the remainder for delivery in 2024/25.

Corn exports found 36.9 million bushels in combined old and new crop sales. Old crop sales were 23% above the prior four-week average, and total sales were near the middle of analyst estimates, which ranged between 23.6 million and 49.2 million bushels. Cumulative sales for the 2023/24 marketing year are still tracking moderately above last year’s pace so far after reaching 1.356 billion bushels.

Corn export shipments slid 21% below the prior four-week average, with 48.5 million bushels. Mexico, Japan, Saudi Arabia, Colombia and China were the top five destinations.

Argentina’s Rosario grains exchange made additional cuts to its corn production estimates for the 2023/24 season, which has now fallen to 1.870 billion bushels. A massive leafhopper infestation that has led to stunting disease has led to losses of around 20%. Under normal conditions, the exchange reported that Argentina’s production potential could have been 2.401 billion bushels.

South Korea purchased 2.6 million bushels of animal feed corn, likely sourced from the United States, South America or South Africa, in an international tender that closed earlier today. Additional shipping details were not immediately available.

Drone sprayer technology has made some sizable advancements in recent years, begging the question: Will drones ever replace ground sprayers? “Drones are considered ‘aerial application.’ There’s a multitude of chemicals that don’t have a label for ‘aerial application,’ and probably never will,” notes Devin Nohl, owner of Minnesota-based spray drone supplier Tenacity Ag. “If the chemical says, ‘Apply from the ground only,’ it’s illegal to fly it in a drone. I don’t see that changing.” Farm Progress digital editor Andy Castillo took a closer look at the situation – click here to learn more.

In the latest edition of Feedback From The Field, farmers largely expressed frustration over soggy field conditions but did report some planting progress over the past couple of weeks. Click here to see how your neighbors are faring so far this season and learn how you can participate! It’s also evident on X (formerly Twitter) that many farmers have been slowed down by wet weather this spring. Here’s one of many examples:

Corn settlements on Wednesday were for 392,287 contracts.

Soybeans

Soybean prices eroded 1.5% lower on a round of technical selling partly spurred by expectations that USDA will show ample global supplies in tomorrow’s WASDE report. May futures stumbled 18.25 cents to $11.9450, with July futures down 18 cents to $12.0975.

The rest of the soy complex was also in the red. July soymeal futures lost 1.4%, while July soymeal futures tumbled 2.5% lower.

Soybean basis bids were steady to weak across the central U.S. after sliding 1 to 5 cents lower across four Midwestern locations on Thursday.

Soybean exports reached 15.9 million bushels in combined old and new crop sales last week. Old crop sales trended 21% above the prior week average, and total sales were near the middle of analyst estimates, which ranged between 9.2 million and 25.7 million bushels. Cumulative sales for the 2023/24 marketing year remain moderately below last year’s pace, with 1.421 billion bushels.

Soybean export shipments were 27% below the prior four-week average, with 11.2 million bushels. China, Egypt, Mexico, Indonesia and Japan were the top five destinations.

A widespread worker strike in Argentina began today in protest of planned austerity measures and other reforms by the new president Javier Milei. That includes stoppages in public transport, grains crushing facilities, supermarkets, airports and banks. “It is a strike that has no reason or apparent justification,” complained spokesperson Manuel Adorni, noting that seven million people will be affected by the lack of public transport. In contrast, a spokesperson of the major CTA union noted that the government “only benefits the rich at the expense of the people, gives away natural resources and seeks to eliminate workers' rights.”

China imported 314.9 million bushels of soybeans in April, which was a 54.7% jump above its March volume, according to the latest customs data.

Dicamba was first approved all the way back in 1967, but recent actions by the EPA have put its use on crops such as soybeans and cotton in jeopardy. Farm broadcaster Mike Pearson took a closer look at the ongoing situation in today’s edition of Farm Progress America – click here to listen.

Soybean settlements on Wednesday were for 232,818 contracts.

Wheat

Wheat prices survived a choppy session with modest gains after a round of technical buying on Thursday. July Chicago SRW futures added 3.25 cents to $6.3725, July Kansas City HRW futures gained 3.75 cents to $6.5225, and July MGEX spring wheat futures picked up 2.5 cents to $7.0525.

Old crop wheat sales slumped noticeably lower week-over-week, but new crop sales brought total volume up to 16.4 million bushels. Combined sales were near the middle of analyst estimates, which ranged between 3.7 million and 25.7 million bushels. Cumulative sales for the 2023/24 marketing year are still slightly above last year’s pace, with 627.3 million bushels.

Wheat export shipments shifted 39% below the prior four-week average, with 12.4 million bushels. The Philippines, Mexico, China, South Korea and Brazil were the top five destinations.

As expected, Japan purchased 4.2 million bushels of food-quality wheat from the United States, Canada and Australia in a regular tender that closed earlier today. Of the total, 41% was sourced from the U.S. The grain is for shipment in July.

CBOT wheat settlements on Wednesday were for 117,290 contracts.

About the Author(s)

You May Also Like